By the time someone comes to checkout from your online store, and to actually commit to pressing the buy button, you have already overcome a substantial host of challenges and potential distractions. At this stage, your customer is convinced that you are credible, they are happy with your headline terms and conditions, and they have their card details or their Paypal account logins ready to get going.

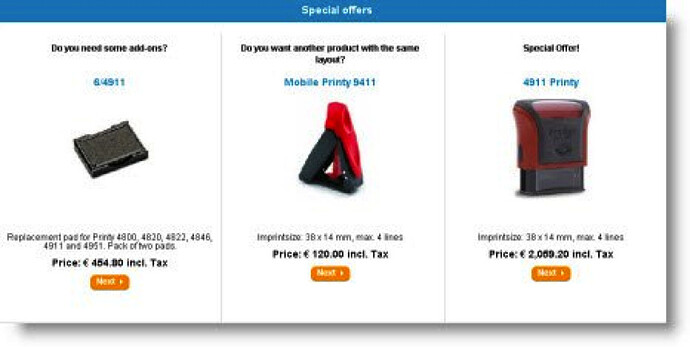

As in any physical retail environment, this is the best time to present them with additional, alternative products. Amazon does this incredibly well, by suggesting products. At this stage, you are about to send a package to the buyer anyway, so you may as well be selling them an extra product, even at a small value, to squeeze maximum efficiency from your marketing and sales process.

By not offering POS add-ons and upgrades, you could be doing yourself out of as much as 20% additional revenue. In the competitive world of online retail, they are sales you can’t just leave on the table.

There are various ways you can present additional products at the point of sale. By ensuring that what you present is visible, complementary and an easy add-on to the shopping cart at the last gasp, you will allow for impulse purchases and extra spending at a time when your customers are almost ready to close the deal.

Up-Selling

Up-selling happens on a daily basis, and it’s almost an expected part of so many mundane transactions that the collective consciousness doesn’t even notice. Do you want to go Large? Extra cheese? Do you want a different color?

Offering your customers the chance to upgrade is an effective way to segment your customers at the point of sale. Those who are price sensitive will stick with the regular price point. Those who don’t care will happily give you more money if you ask them to. It’s this crucial differentiation technique that allows retailers to squeeze a bit more profit from customers who are willing to pay it.

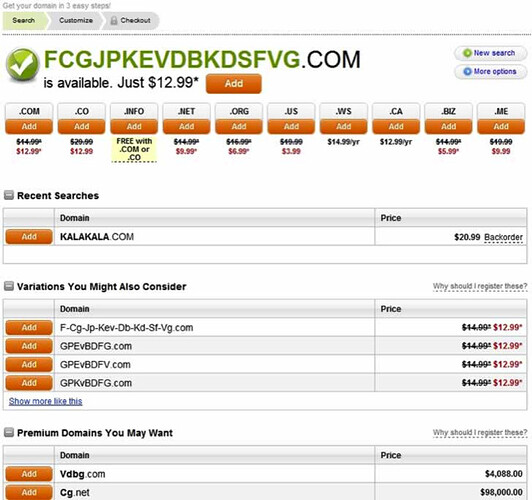

Think about ways you can up-sell for your products, and implement them from the beginning to maximize your overall sales. GoDaddy is one incredibly successful company that loves to up-sell, almost to the point of irritation. They don’t do it to be deliberately obnoxious – it’s because this helps squeeze more money out customers when the customers are obliging, and to not ask would be to shave a hefty chunk off the business.

Cross-Selling

Similar to up-selling, cross-selling is the positioning of other products that your customers might like to buy. If someone buys a bucket, the might also be interested in buying space, and cross-selling puts this opportunity to them.

Think of Amazon’s ‘other shoppers also bought these products’ – this form of marketing is again reaching out to customers with the budget to buy more, and making them a highly targeted offer. This way, you can sometimes sell two products, rather than always selling a guaranteed one.\

Payment Gateways

Payment gateways are important to your customers because shoppers have doubts when buying anything online. In a nutshell, a payment gateway is an eCommerce application service provider that authorizes credit and debit card payments for online businesses and online retailers. An easy way to get your head around a payment gateway and what it might look like is by liking it to a physical point of sale in a shop - it handles the transactions between vendor and customer.

Your payment gateway can reassure your customer that you are legitimate, or put them off entirely if you make the wrong choice. It can also determine whether your customer has a smooth checkout process, or it takes too long.

At the split second of purchase, these issues matter a great deal to your conversion rates, and so taking care when choosing how to handle payments is highly recommended.

If you want to take payments, understanding what a payment gateway is and how it fits into your business is important. A payment gateway is a secure link between your eCommerce website and your merchant bank. Equally important is understanding the implications of taking card payments – you’re about to start taking highly confidential customer data, after all. The gateway protects customer credit/debit card details by encrypting this sensitive information – like the actual credit/debit card numbers – and ensures that this information is passed safely between 1) the customer and the merchant and 2) the merchant and the payment processor.

This how a secure payment gateway works (and it takes 2 seconds):

- Your customer is on your eCommerce website and decides to buy a product, so submits an order

- The transactional information is relayed to the payment gateway’s secure connection where it is encrypted

- The payment gateway then forwards the information to your acquiring bank’s payment processor

- The payment processor forwards the transaction information over to the association that the card used belongs to e.g. Mastercard or Visa

- Next, the credit or debit card’s bank receives this request and sends a reply to the processor with a special code which signals whether the transaction will pass or fail e.g. if there aren’t sufficient funds available in the bank account

- The payment processor then sends this message onto the payment gateway

- The payment gateway receives the message and then forwards it onto your website – and then sends this information back to the cardholder and also the merchant.

Fees

There are two types of charges that can factor in when choosing your preferred gateway – sign up/service fees and transaction fees. Some payment gateways require an upfront fee and/or a monthly flat fee to use, plus a transaction fee, usually a small percentage on each transaction.

Others are free to sign-up but charge a transaction fee. Payment processing fees are a cost of doing business, so it’s important to think about cost comparisons carefully – small savings can make a big difference when multiplied over sizeable transaction volumes.

Advantages of accepting online card payments

- Consumers expect to be able to pay by card (and multiple card types)

- Setting up a payment gateway is quick and easy – and payment occurs at the time of sale

- Card payments are more secure than cash

- Debit and credit transaction costs are transparent

- You can attract global customers

6 payment gateways options:

There are several natural choices most people opt for when it comes to payment gateways, and in reality, these are the most familiar to consumers. Let’s look at a few of our favorites.

Paypal

Paypal is trusted. Most people have a Paypal account or have at least heard of Paypal, so they trust putting their money through it. For all the service isn’t necessarily the best seller experience, it is particularly buyer-friendly, and this is the reason so many people persist with using it. Perhaps the major drawback of using Paypal is that it’s relatively expensive, with a 20p + 3.4% charge per transaction. Especially for smaller purchases, this can be a considerable cost.

Ultimately, Paypal gets used because customers like it. And the bottom line is that you’ve got to let the customers decide.

Paypal Pros

- Familiarity: Your customers are already familiar with Paypal as it has a strong household name with a global customer base. They trust the brand, and may even have an existing Paypal account themselves. This makes Paypal a front-runner for any eCommerce site, as at the very least one of several payment options available.

- Existing Funds: Your customers may have existing funds within their Paypal account, which they are more likely to feel prepared to spend. Because Paypal is used so widely, this can have an upwards impact on your conversions.

- Flexibility of International Payment: Ideal for receiving payments from buyers across the world, Paypal is a flexible solution in terms of serving local currencies and converting into your own base currency, saving you a number of common eCommerce headaches.

- Partnership: Paypal has partnered with fellow payments provider, Braintree.

- Multiple Payment Options: Paypal conveniently accepts multiple card payment methods.

- No Merchant Account Required: You don’t need a merchant account – simply log in with your email.

- No SSL Certificate. You also don’t need an SSL certificate.

- No Monthly Charges.

- PAYG: PayPal introduced the PAYG model – useful for start-ups.

- WordPress Compatibility: Supports eCommerce websites that operate using WordPress with special plugins e.g. if you operate using WooCommerce, you can benefit from PayPal Advanced and PayPal Express (among others).

Paypal Cons

- Expensive: Paypal isn’t exactly cheap, and depending on your set up you could be paying a monthly fee in addition to the flat and percentage portion of each transaction (individual transaction fees are much higher than most payment gateways). These costs can seriously mount with volume, eroding your margins, and making your job much more difficult.

- Off-site: Paypal takes your customers off-site, through their own gateway in order to process the sale. This can have a negative impact on conversion rates, especially for larger online retailers who may prefer to make these marginal gains through retaining the sale on-site throughout.

- Flow Issues: Paypal’s website has something of a retro feel to it, and it hasn’t been visually revamped to any great extent in years. For some sales, this could have a less than desirable effect on your conversions.

- Holding of Transactions: They hold 30% of vendor transactions for 90 days.

- Slow Support – They operate a 24-hour email service.

Stripe

Would-be industry up-starts Stripe have become serious players, catering to merchants in a way that Paypal doesn’t. Stripe can be integrated within your e-commerce site directly, which means customers never actually leave your shop. With Paypal, they are routed through the Paypal website. On a large scale, even this incremental difference could detract from the desired consistency of your shopper’s experience through the payment process, which makes a solution like Stripe more applicable.

If it’s not a feature thing, eCommerce sites are choosing Stripe because is compatible with a wide range of payments, and much cheaper than Paypal in terms of transaction fees.

Stripe Pros

- Cheaper Than Paypal: Stripe is cheaper than Paypal for most transactions, which is enough reason in itself to make it a serious contender. It costs between 5% – 2.9% plus a 20p flat rate for transactions and there are no monthly fees.

- Easy To Integrate: As integrations go, Stripe is reasonably straightforward. However, if you aren’t technically minded, you’ll almost certainly need support to get Stripe functioning effectively on your website.

- Keep Checkout On-Site: In a conversions business, sending your customers somewhere else to complete payment isn’t always desirable. With Stripe, customers are still on your site with your branding, so they can feel more certain during the checkout process.

- Good Exposure: It’s privately owned and has profited from a lot of PR and exposure.

- Start-up Friendly: It has a strong focus on small businesses and start-ups.

Stripe Cons

- Expensive for Debit Card Transactions: 2.4%+20p is expensive for debit transactions, and other payment providers do have cheaper costs for debit cards (as opposed to credit card) purchases.

- Requires Integration: While it’s easy enough to integrate, this is still a process that will require external assistance for most people, without the technical skills required to hook things up effectively

- Email Only Support: For a mainstream payment processor like Stripe, this isn’t really good enough. Support comes only via email, and while their support function is quick, it’s not ideal to be waiting on an email response to often time-critical gateway issues.

- Developer built: It’s built mostly for developers, which can leave some vendors feeling out of their depth.

- Increased Volume Leads to Increased Fees: The more you sell, the more the transaction fees increase (more obviously than with other payment gateways).

- SSL Certificate Requirement: You will need a SSL certificate.

- Supplier Charges: There are supplier charges for PCI DSS compliance.

- Not Mobile Friendly: Do not support mobile payments (right now).

Amazon Payments

Amazon Payments is another great payment processor you can use, bringing the trusted name and brand of Amazon to your checking out process. Most people who buy from you can just log-in to their Amazon account to pay, or will have little resistance to checking out through Amazon if they haven’t done so before. This can be a major asset in finally closing the deal, and converting as many nearly buyers into actual sales as possible.

Amazon is probably best used for those selling items over £20, because the per transaction fees can be very high for low-level transactions when compared to other payment processors.

Amazon Payments Pros

- Strong Seller Protection: Amazon back up their sellers, and provided you play by the rules of the programme, you will be protected against common fraudulent activities in the course of your ecommerce business.

- Convincer For Customers: Like Paypal, people know and trust the Amazon brand, and may even have their own Amazon account at present. This is perfect for convincing and reassuring during the checkout process, helping to prevent abandonments and lost sales.

- All Compliance Handled: With Amazon Payments, there are no need to worry about additional compliance requirements or merchant accounts, all of which are handled by Amazon on your behalf.

Amazon Payments Cons

- Maximum Purchase Levels (20 items): Staggeringly, Amazon Payments only allow 20 items to be purchased on a single transaction. For reasons unknown, this decision could have an impact on certain types of eCommerce businesses using Amazon Payments.

- Same Costs as Paypal: Amazon Payments is benchmarked against Paypal in terms of its costs, which can quickly become a significant burden for eCommerce retailers.

Authorize

Authorize is feature-heavy, but it comes at a price. If you want to Authorize, you need to pay a $99 signup fee, plus $20 monthly to use the service, plus a $0.10 transaction charge. However, for merchants with particular, specialist requirements, these costs do make sense.

For example, Authorize has particularly advanced fraud protection features, which allow you to block certain known fraudulent IPs and to set filters for suspicious transactions and buying behavior. Even filtering one or two fraudulent transactions can pay to Authorize fees, so it’s easy to see how this could be a preferable option.

Authorize is owned by Visa, so you know you are dealing with a serious company. You do need to implement the gateway yourself, but those selling in volume will already know if this is the best option.

Authorize Pros

- Good Support: Authorize support are on hand to help resolve any issues you experience along the way, with a responsive, helpful team at your disposal.

- Low Transaction Fees: Once you get over the setup fees, the per-transaction fees are much lower with Authorize relative to other payment processors, resulting in significant savings for volume sellers.

- Integrates Well With Ecommerce Platforms: Authorize payment gateways are easy to integrate across different eCommerce platforms, and well supported through various eCommerce and shopping cart scripts.

- Variety: They have an answer for every different type of eCommerce store.

- Compliance: They are PCI DSS compliant.

- Multiple Payment Options: There are numerous payment options available including recurring payments, customer information management, and more.

- QuickBooks: It integrates with QuickBooks.

Authorize Cons

- Requires Merchant Account: Authorize doesn’t come with a merchant account, and you will need to set this up separately before you can use the service. Merchant accounts can be a headache for eCommerce retailers to set up and maintain.

- Requires Additional Compliance: Because of the structure of the Authorize.net service, you need to take care of additional compliance steps to stay legal.

- Setup Fees: The setup fees for Authorize.net are a downside to bear in mind, although most eCommerce retailers can recoup these over time in terms of savings on the cost of per-transaction fees.

- Monthly Fee: There is a £20 monthly payment for the gateway itself.

- Restricted Mobile App: Their mobile app is somewhat limited.

- No Monthly Reporting Tools.

Intuit

Founded in 1983, Intuit is one of those payments companies that has been around for a long time – they are seasoned payments professionals who can offer merchants the whole eCommerce package. However, Intuit is not especially prevalent internationally, with most of its business happening in the US.

Pros

- Low Fees : Its a 4% + 20p transaction fee per swiped transaction. There are no monthly fees or set up fees.

- Simple Integration: It’s easy to integrate with most eCommerce platforms.

- Speed: Its quick to get a merchant account.

- QuickBooks Friendly: If you use QuickBooks to keep your accounts then you’re in luck, as Intuit is probably the payment gateway that integrates best with this software.

Cons

- Transaction fees: 4% + 20p per keyed transaction.

- Account reconciliation: Conversely, if you don’t use QuickBooks, you might find account reconciliation with other software quite a challenge.

Worldpay

Prevalent worldwide, Worldpay is one of the biggest payment service providers out there. Worldpay offers a whole host of services and has competitive rates. They are not known for their customer service though, so it depends if the human touch is part of what you’re looking for – and how much support you might need.

Pros

- Speed: Worldpay is very quick at obtaining merchant accounts for new businesses.

- Multichannel: They are full multichannel – so the chance to expand your business into other channels is a possibility.

- Easy Invoicing: If you intend to operate your business using invoicing, Worldpay offers an eInvoicing service.

- PayPal Integration: Worldpay allows payment through PayPal integration.

- Economies of Scale: Fees reduce with a large volume of sales.

- Quick Set-up Process.

Cons

- Not Ideal for Small Businesses: While Worldpay is global with strong positioning, they are more focused on larger businesses.

- Capped Transactions and Bespoke Pricing: This may be a con or a pro, but Worldpay operates using capped transactions and bespoke pricing. So your prices will depend on what you’re quoted at the time.

- Additional Charge: Fraud support is charged additionally.

- Set-up Fees: The setup fee is expensive.

- Weak Sales Approach: Worldpay are not known for their sales approach.

- Contracts: Customers are often tied into contracts.

- PCI DSS Charges.

While these payment gateways are by no means the only ones on the market, they can offer start-ups and new businesses a comprehensive and solid eCommerce experience. They are all well-established enough in their own right, but the one you choose will depend not on them but on your business. For example, if you’re planning the steady and swift expansion, then opting for a payment gateway that doesn’t charge for high volumes of sales might be worthwhile. And, for small businesses happy to tick along finding their own feet, you might prefer a gateway that doesn’t charge for set up or have any monthly fees so you can keep your costs down while you get to grips with eCommerce.

Should You Force Sign Up To Checkout?

Some merchants force buyers to sign up, or to log-in before they are able to check out their purchase. It is easy to understand the reasoning for this – by securing the sign-up, you get the chance to harvest important data, most pertinently the email address of your buyer, so you can pitch them offers in the future. But is this worth the potential implications on your conversion rates?

Any barrier to the checkout process is likely to have a negative effect on your conversion rates, reducing the numbers of those who will see the purchase through to its conclusion. Guest checkout is an absolute must if you want to optimize your web conversions. That doesn’t mean you have to lose out on all that valuable data – it’s about putting the customer experience at the core of your payment and checkout process, so it’s as easy as possible to give you money. Anything else can be collected after the event, in a way that doesn’t hinder your conversions like forced signup.